Have you ever wondered if you could skip the endless paperwork of a mortgage application and buy a property outright? In 2025, a surprising trend emerged: over 30% of UK home purchases were cash deals, according to HM Land Registry data. That is a massive chunk of the market moving without a bank’s help.

The short answer is a resounding yes. In fact, with interest rates recently hovering comfortably between 5% and 6%, cash buying has surged in popularity. It’s no longer just for the super-wealthy; it’s becoming a strategic move for downsizers, investors, and anyone looking to secure a home quickly in a competitive market.

If you are sitting on savings, inheritance, or equity from a previous sale, this guide is for you. We are going to walk you through everything you need to know about buying a house with cash in the UK. We will cover the feasibility, hidden costs (yes, there are still costs!), massive benefits, and potential downsides. Plus, we’ll share tips on how to close a deal in record time.

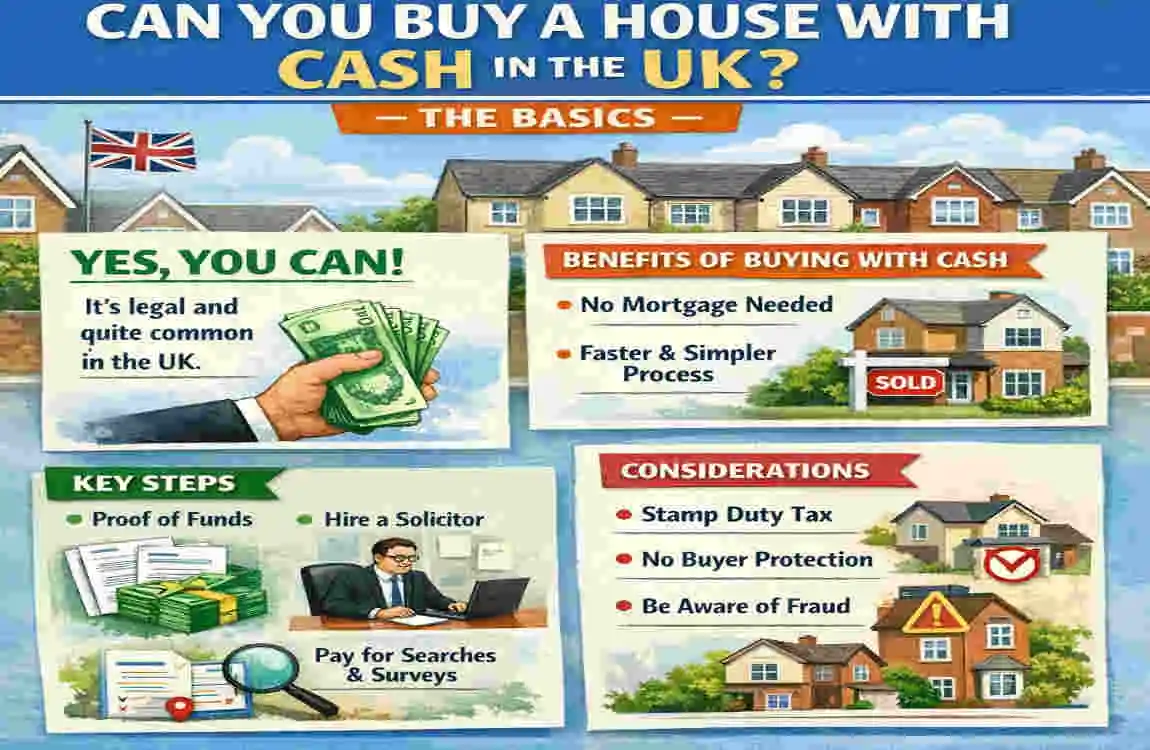

Can You Buy a House with Cash in the UK? The Basics

First things first, let’s define what we actually mean by “cash buying.” When estate agents talk about a cash buyer, they aren’t suggesting you walk into their office with a briefcase full of £50 notes like a scene from a spy movie. That is actually illegal under anti-money laundering laws!

In the property world, being a cash buyer means you have the liquid funds available in your bank account to cover the entire purchase price of the property at the time of exchange. You do not need a mortgage, a loan, or to sell another property first to release the funds.

Who Qualifies as a Cash Buyer?

Technically, anyone with the money qualifies. You don’t need a high credit score, you don’t need to prove your income to a lender, and you certainly don’t need to wait for a bank to approve the property’s value.

However, “cash” must be accessible. If your money is tied up in stocks, bonds, or a property that hasn’t sold yet, you are not considered a procedural cash buyer until that money is sitting as cash in your account.

The Current Market Landscape in 2026

Why is everyone talking about this now? The UK property landscape has shifted. With mortgage rates sitting higher than they were a decade ago, the cost of borrowing is steep.

Recent data suggests that cash buyers accounted for roughly 37% of sales in England and Wales at the start of 2026. This is largely driven by:

- Downsizers: Older homeowners selling large family homes and buying smaller, mortgage-free properties.

- Investors: People looking for buy-to-let opportunities who want to avoid high mortgage interest eating into their rental yield.

- International Buyers: For example, we are seeing increased interest from expats in cities like Lahore and Dubai seeking stable assets in the UK market.

Busting the Cash Myths

Let’s clear up a common misconception right now. People often think, “I’m paying cash, so I don’t need a solicitor, and I don’t need checks.”

This is false.

Even though you don’t have to satisfy a lender, you absolutely should satisfy yourself. You still need to pass strict anti-money laundering (AML) checks to prove where your money came from. And unless you want to risk buying a house that is falling or has legal title issues, you still need surveys and legal work. Cash simplifies the finance side, but the legal transfer of ownership remains the same.

Step-by-Step Process: How to Buy a House with Cash in the UK

So, you have the funds and you are ready to buy. How does the process actually work? It is significantly faster than a mortgage purchase, but it follows a specific rhythm. Here is your roadmap.

Find a Property and Make an Offer

You start just like everyone else—scrolling through Rightmove or Zoopla. However, you have a secret weapon: you are a cash buyer.

When you make an offer, emphasize your position. Sellers love cash buyers because there is no risk of a mortgage application being rejected. Consequently, you can often negotiate a discount. It is not uncommon for cash offers 10% to 20% below the asking price to be accepted over higher offers from buyers involved in a complicated chain.

Instruct a Solicitor or Conveyancer

Once your offer is accepted, you need a legal professional. Do not skip this. You need someone to handle the contract, transfer the money, and register you as the new owner.

- Cost: Expect quotes between £800 and £1,500.

- Action: Tell them immediately that you are a cash buyer so they can prioritize your file.

Arrange Surveys

Since you don’t have a lender forcing you to get a valuation, you might be tempted to skip the survey to save money. Don’t do it.

A lender’s valuation is for their protection; a private survey is for yours. Whether it’s a HomeBuyer Report (Level 2) or a full Building Survey (Level 3), you need to know if the roof leaks or if there is subsidence. This will cost between £400 and £800, but it could save you thousands in repairs later.

Proof of Funds and Searches

Your solicitor will ask for proof of funds early on. You will need to provide bank statements showing that the funds have been in your account for a certain period. They will also run “searches” on the property (checking for flood risks, planning permissions, etc.).

As a cash buyer, you can opt out of searches to speed things up (this is called buying with “no search indemnity insurance”), but it is risky.

Exchange of Contracts

This is the big moment. When you and the seller are happy, your solicitor swaps signed contracts with the seller’s solicitor.

- Difference: With a mortgage, this can take 12-16 weeks to reach. With cash, you can be here in 4 weeks.

- Commitment: At this point, you pay a deposit (usually 10%), and the deal is legally binding.

Completion

On the agreed date, your solicitor transfers the remaining balance of your cash to the seller’s solicitor via a CHAPS payment (usually costing a £25-£50 bank fee). Once the money lands, you get the keys!

Timeline: While a traditional purchase takes 3-4 months, a focused cash deal can easily be done in 4-8 weeks.

Full Breakdown of Costs: Buying a House with Cash UK

One of the biggest advantages of cash buying is avoiding mortgage interest. However, buying a house is never “free” of fees. You need to budget carefully to ensure your liquid cash covers not just the house price but also the transaction costs.

Here is a detailed look at what you will pay.

Stamp Duty Land Tax (SDLT)

Whether you borrow the money or pull it from under your mattress, the taxman still wants his cut. Stamp Duty is charged on the purchase price of the property.

As of the current 2025/2026 rates in England and Northern Ireland:

- £0 – £250,000: 0%

- £250,001 – £925,000: 5%

- £925,001 – £1.5 million: 10%

Example: If you buy a house for £400,000:

- First £250k = £0

- Remaining £150k @ 5% = £7,500 tax bill.

Note: If this is a second home or buy-to-let, add a 3% surcharge to these rates.

Legal and Conveyancing Fees

You might think, “Less work for the lawyer means lower fees, right?” Sometimes. While they don’t have to deal with a lender, they still have to check the title deeds and run money laundering checks.

- Fees: £800 – £2,000 + VAT.

- Disbursements: These are costs the lawyer pays on your behalf (ID checks, bank transfer fees), usually around £300-£500.

Surveys and Local Searches

- Survey: £400-£1,000, depending on the size of the house.

- Local Authority Searches: £200–£400. (Optional for cash buyers; highly recommended.)

Hidden Extras

Don’t forget the boring stuff:

- Land Registry Fee: £100 – £500 (to register the deed in your name).

- Insurance: You need buildings insurance from the day you exchange contracts—budget £200+ per year.

- Moving Costs: Removals can cost £500-£2,000.

Total Cost Estimate Table

To help you budget, here is a breakdown of what you might pay in extras on top of the purchase price (assuming it’s your only home):

Property Price Stamp Duty (SDLT)Legal & Surveys Misc. Fees Total “Cash” Costs

£250,000 £0 £1,500 £500 £2,000 – £2,500

£500,000 £12,500 £2,000 £700 £15,200+

£800,000 £27,500 £2,500 £1,000 £31,000+

£1,000,000+ £41,250+ £3,000+ £1,500 £45,750+

Pro Tip: Always budget an extra 2% to 5% of the property price for these closing costs so you aren’t caught short on completion day.

Pros and Cons of Buying a House with Cash in the UK

Is emptying your savings account really the best move? It depends on your financial goals. Let’s weigh it up.

Key Pros: Why Cash is King

- Serious Negotiating Power: Money talks. If a seller wants a quick sale, they will often accept a lower offer from you because you represent certainty. You aren’t part of a “chain” that could break. You could save tens of thousands of pounds just by being a reliable buyer.

- Total security: You own the home 100%. No bank can repossess it if you lose your job. That peace of mind is priceless for many people, especially retirees.

- Speed: We’ve mentioned this, but it bears repeating. You can move in months sooner than if you were waiting for a mortgage broker.

- Long-Term Savings: Think about the interest. On a £300,000 mortgage at 5% interest over 25 years, you would pay back over £200,000 in interest alone. Buying with cash saves you that fortune.

Key Cons: The Downside of Cash

- Tying Up Capital: This is the big one. Once that money is in the house, it is “illiquid.” You can’t spend it on groceries, holidays, or emergencies. If you need money fast, you have to sell the house or remortgage.

- Opportunity Cost: Could that money earn more elsewhere? If the stock market is returning 8% and your mortgage would only cost 5%, you might actually lose money in the long run by paying cash.

- Risk of Overpaying: Mortgage lenders act as a buffer against overpaying. They won’t lend on a house if it’s overpriced. Without them, you rely entirely on your own judgment (and your surveyor).

- No Tax Relief (for Landlords): If you are a buy-to-let investor, buying with cash means you can’t deduct mortgage interest costs (though tax rules have changed significantly here recently, leverage is still a common strategy).

Fast Closings: Tips for Speedy Cash House Purchases in the UK

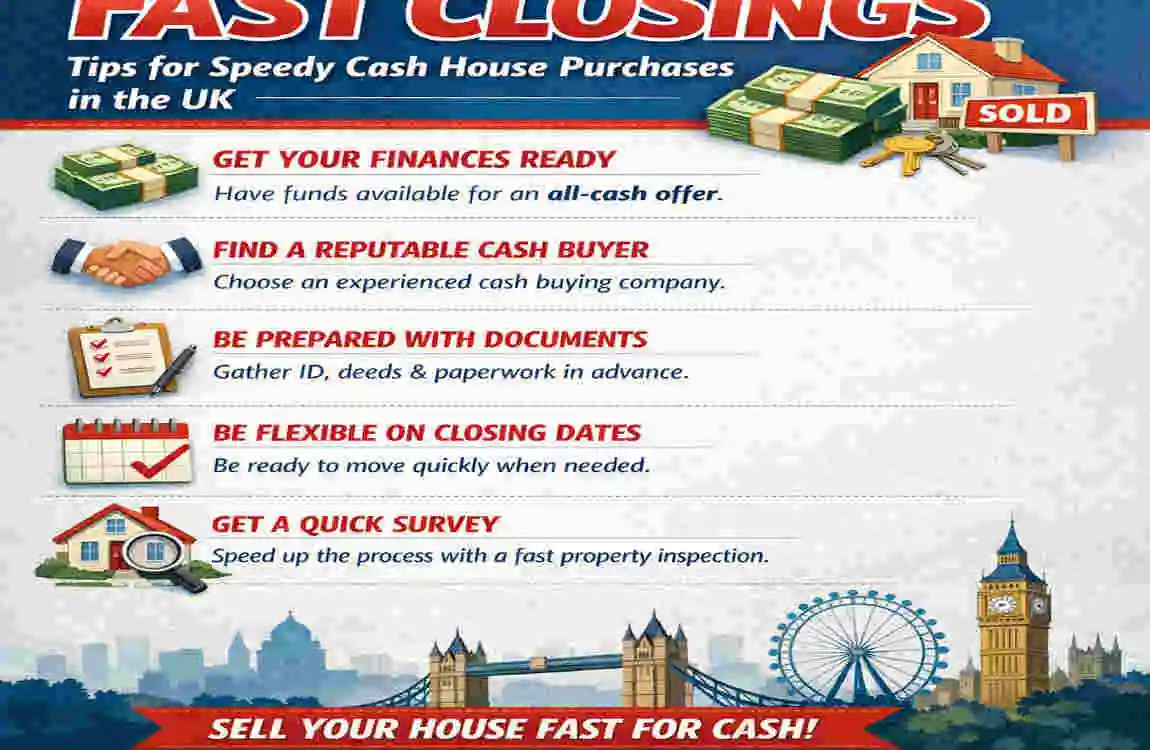

You have the cash, and you want the house now. While the average cash deal takes a month or two, it is possible to do it much faster—sometimes in as little as 14 days.

Here are my top tips for a lightning-fast completion:

Choose the Right Seller

Look for vacant possession properties. If the seller has already moved out, or if it is a probate sale (an inherited property), there is no chain. Chains are the number one cause of delays.

Get Your ID and Funds Ready

Solicitors are legally required to verify your identity and the source of your wealth. Don’t wait for them to ask. Have your passport, utility bills, and 6-12 months of bank statements ready to email on Day 1.

Pre-Approve Your Solicitor

Don’t wait until your offer is accepted to find a lawyer. Find one beforehand. Ask them specifically: “Do you have the capacity for a fast-track cash purchase?” If they are too busy, find someone else.

Consider “No Search” Insurance

Local authority searches can take weeks. As a cash buyer, you can instruct your solicitor to skip them and instead buy an indemnity insurance policy. This protects you financially if something nasty (like a compulsory purchase order) turns up later.

- Warning: This is risky. Only do this if you know the area well or are willing to take the gamble.

Use Digital Estate Agents

Services like Purplebricks or YOPA often have streamlined digital dashboards that keep things moving faster than traditional agents who might take weekends off.

Avoid Completion on Fridays

Everyone wants to move on a Friday. This means banks and solicitors are overwhelmed, and transfers often fail or get delayed until Monday. Aim to complete on a Tuesday or Wednesday for a smoother transaction.

Is Cash Buying Right for You? Alternatives and Considerations

Buying with cash is fantastic if you can afford it, but it isn’t the only way to secure a property.

Who is it ideal for?

- Retirees: Those looking to minimize monthly outgoings.

- Expats: International buyers who might struggle to get a UK mortgage due to lack of credit history.

- Fixer-Upper Hunters: Banks often won’t lend on properties without a kitchen or bathroom. Cash is the only way to buy these derelict bargains.

Alternatives: If you want the speed of cash but don’t have the full amount, consider a Bridging Loan. This is a short-term, high-interest loan that acts like cash. It’s useful for auction purchases, but be careful—rates are high.

2026 Outlook: With inflation stabilizing, we might see mortgage rates dip slightly later this year. However, cash remains the ultimate “power card” in negotiations. If you have the liquidity, use it to drive a hard bargain.

FAQs: Can You Buy a House with Cash in the UK?

How long does a cash house purchase take? On average, 4 to 8 weeks. However, with a motivated seller and efficient solicitor, it can be done in under 14 days.

Do cash buyers pay less Stamp Duty? No. Cash buyers pay the same Stamp Duty Land Tax (SDLT) rates as mortgage buyers.

Do I need a survey if I’m paying cash? Legally, no. Practically, yes. Without a survey, you are buying “blind” and will be responsible for all structural defects you discover later.

Can I buy a house with actual physical cash? No. Due to money laundering regulations, you cannot pay for a house with a suitcase of banknotes. Funds must be transferred via bank transfer.

Is it cheaper to buy a house with cash? Yes, in the long run. You save thousands on mortgage interest and arrangement fees. You can also often negotiate a lower purchase price upfront.