It is the most common anxiety sellers face. You don’t want to price it so high that it sits on the market for months, gathering dust. But you definitely don’t want to price it too low and walk away leaving thousands of dollars on the table. You worked hard for that equity, and you deserve to keep it.

If you are wondering how to accurately value mobile home assets, you are in the right place. The market has shifted quite a bit. In fact, mobile home sales reached an impressive level in late 2025, indicating that demand is stronger than ever. But here is the catch: manufactured homes don’t play by the same rules as traditional stick-built houses.

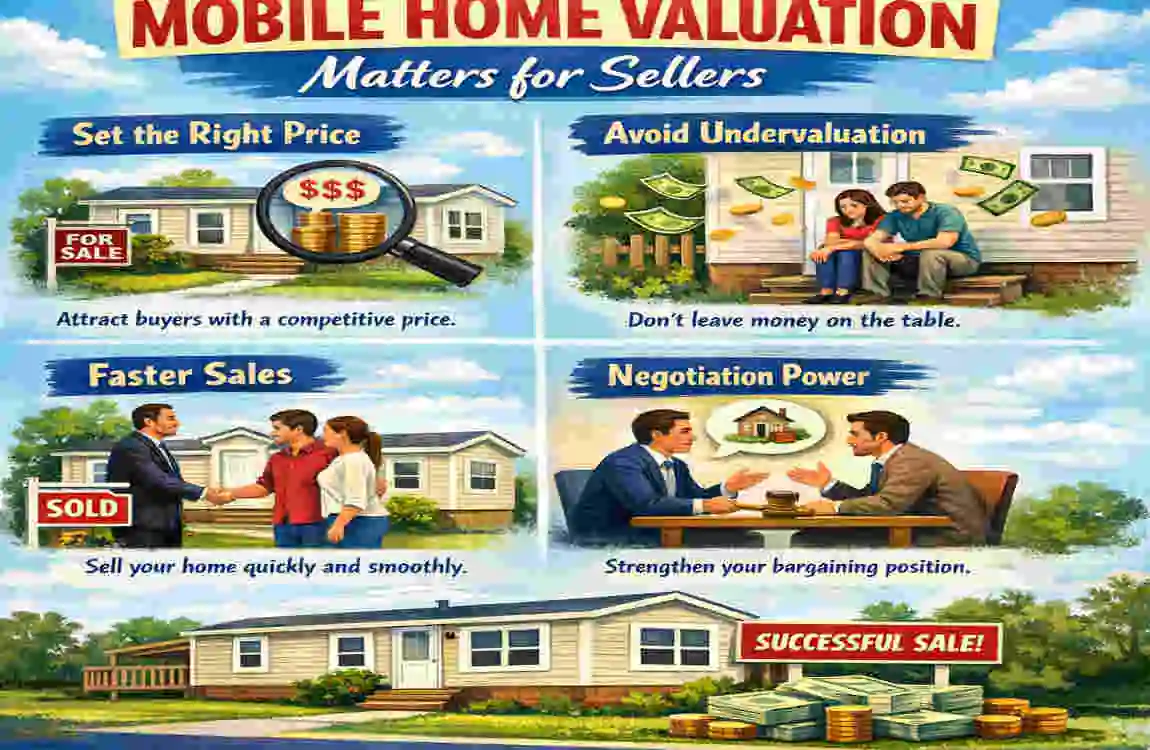

Why Accurate Mobile Home Valuation Matters for Sellers

You might be tempted to look at what your neighbor sold their home for and slap a similar price tag on yours. Please, don’t do that.

Valuing a mobile home is a unique beast. Unlike traditional real estate, where land and structure are usually a package deal, mobile homes (especially those in parks) are often considered personal property rather than real estate. This distinction changes everything—from how banks lend money to buyers, to how appraisers look at your home.

The Risks of Getting It Wrong

If you guess your price, you are gambling with your financial future.

- Overpricing: If you list too high, your home sits. In the current 2026 market, data suggests that homes listed 10% above market value sit on the market for three times as long. Eventually, you will have to drop the price. When buyers see a price drop, they smell desperation, and they will lowball you even further.

- Underpricing: the silent killer. You might sell in a week, but if you could have gotten $10,000 more, that is money that could have gone toward your retirement or your next home.

Getting an accurate value for your mobile home gives you confidence. When a buyer asks, “Why is it priced this way?”, you can look them in the eye and show them the data.

Mobile Home Valuation: Myths vs. Facts

There is a lot of bad advice floating around on the internet. Let’s clear the air right now.

Valuation MythThe Reality (Fact)

“Mobile homes always depreciate like cars.” False. Well-maintained homes, especially on owned land or in desirable parks, can appreciate alongside the local housing market.

“NADA Guides are the only number that matters.” False. Book value is just a baseline. Local market demand and condition are the real drivers of price.

“Renovations give you a 100% return.” False. While upgrades help, you rarely get dollar-for-dollar value back. It depends heavily on which upgrades you choose.

“Zillow Zestimates are accurate for mobile homes.” False. Algorithms struggle with manufactured homes because they often lack data on lot rent and specific model types.

Factors That Influence Mobile Home Value

Before we get into the math, you need to understand the levers that move the price up or down. Think of your home’s value as a recipe; if you change one ingredient, the final result changes.

Age and Condition

This is the big one. In the world of manufactured housing, the HUD Code is the dividing line. Homes built after June 15, 1976, are “manufactured homes” and adhere to strict federal construction standards. Homes built before that date are “mobile homes” and are significantly harder to finance and insure.

If your home is post-1976, its value is inherently higher because a buyer can actually get a loan for it. Beyond the year, condition is king.

- Roof: Is it a “roof-over,” metal, or shingle? Buyers fear leaks.

- Flooring: Soft spots are a deal-breaker.

- Systems: How old are the HVAC and water heater?

Location and Park Rules

If real estate is “location, location, location,” mobile home value is “location, lot rent, park reputation.”

You can use the same double-wide model in two different parks. In a 5-star park with a pool, gated entry, and strict rules, that home might be worth $120,000. Put it in a run-down park with potholes and loose dogs, and it might struggle to sell for $40,000.

Lot rent is a crucial factor that sellers often forget. If your park charges high lot rent, your home is worth less. Why? because the buyer has a monthly budget. If they have to pay the park $1,000 a month, they can afford less for your mortgage/purchase price.

Size, Model, and Features

This is straightforward: bigger is usually better.

- Width: Double-wides almost always command a premium over single-wides because they feel more like a traditional house.

- Layout: Split floor plans (main bedroom on one side, guest rooms on the other) are highly desirable.

- Specs: 2×6 sidewalls, drywalled interiors (tape and texture) instead of batten strips, and pitched roofs add significant value.

Market Trends (2026 Update)

We are currently in a fascinating market. With the cost of site-built housing skyrocketing, the demand for affordable housing has surged. In early 2026, we are seeing a “flight to affordability.” This means well-kept manufactured homes are getting multiple offers, if they are priced correctly.

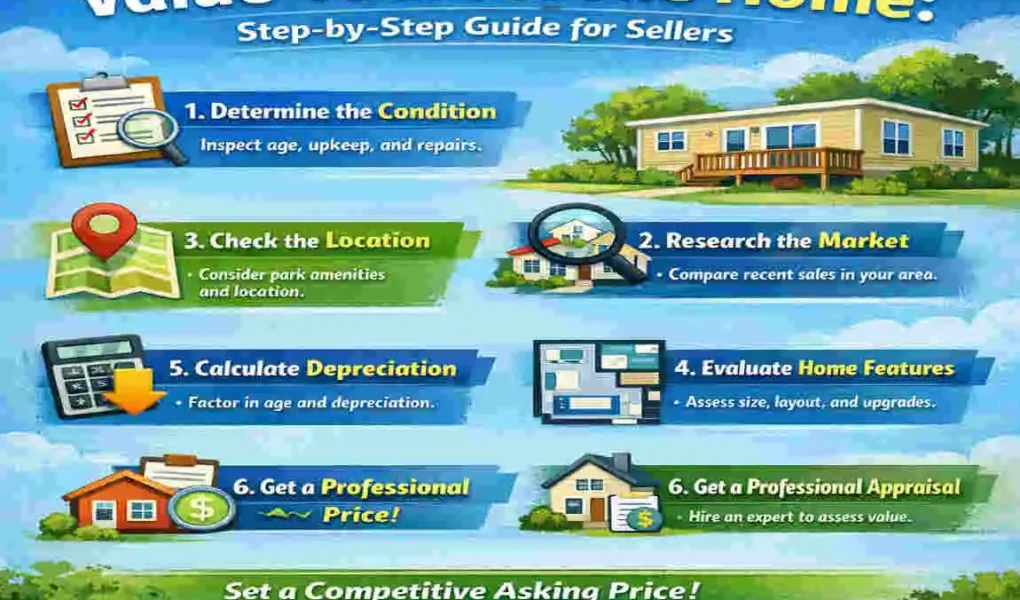

Step-by-Step Guide: How to Value Your Mobile Home

Okay, this is the core of our guide. Grab a notebook and a pen. We are going to go through the exact workflow a professional appraiser would use, but simplified for you.

Here is your step-by-step guide to valuing mobile homes for sale.

Gather Basic Info on Your Mobile Home

You cannot price what you cannot identify. Before you look at a single price online, you need your home’s “vital stats.”

Go to your home and find the Data Plate. This is a paper sheet usually glued inside a kitchen cabinet, near the electrical panel, or in the main bedroom closet. Do not confuse this with the HUD tags (the metal plates on the exterior).

You need to write down:

- Manufacturer: (e.g., Clayton, Fleetwood, Champion)

- Model Name/Number:

- Date of Manufacture: (Month and Year)

- Serial Number (VIN):

- Dimensions: Length and Width (excluding the tow hitch).

Research Comparable Sales (The “Comps”)

This is the most important step in learning how to value mobile home assets. You need to find “Comps”—recently sold homes that are similar to yours.

Where to look:

- MHVillage: This is the largest database for manufactured homes—filter by “Sold” listings in your area.

- Zillow/Realtor.com: Filter for “Manufactured” and “Sold.”

- Your Park Office: If you live in a community, walk into the manager’s office. Ask them, “What have comparable homes sold for in the park over the last six months?” They often know the numbers that don’t make it to the internet.

How to filter: Look for homes that are within +/- 5 years of your home’s age, have similar square footage, and are typically within a 5-mile radius (ideally, in the same park).

Assess Condition and Upgrades

Be honest with yourself. Take off your “homeowner goggles” and put on your “inspector goggles.”

Walk through your home.

- The Negatives: Do you have water stains? Are the windows drafty single-pane aluminum? Are the appliances 15 years old? You must deduct value for these. If your home needs $5,000 in repairs, subtract that from your baseline.

- The Positives: Did you install a metal roof? Did you put in luxury vinyl plank flooring? Did you upgrade to a smart thermostat?

The Rule of Thumb for Renovation Value: You generally add about 10-20% to the value for significant, high-quality renovations. Do not expect to get back exactly what you paid. A $10,000 bathroom remodel might only add $6,000 to the sale price, but it will make the home sell faster.

Calculate Land and Park Fees Impact

This is where the math gets tricky, but stick with me.

Scenario A: You Own the Land If your mobile home is on its own private land and “deeded” as real estate, you are sitting on a goldmine. You value the land + the home together. These are the highest-value comps.

Scenario B: You Are in a Park (Leased Land) The “Book Value” of your home might be $60,000. However, if the park lot rent is $900/month, that is expensive for a buyer.

- Low Lot Rent = Higher Home Value.

- High Lot Rent = Lower Home Value.

If your lot rent is significantly lower than that of neighbouring parks, your home is worth a premium! Highlight this in your listing.

Use Free Online Valuation Tools

Now that you have your data, plug it into the tools.

- NADAguides: This is the “Blue Book” for mobile homes. You can pay a small fee to get a detailed report. Banks widely respects it.

- J.D. Power: They offer detailed valuation services similar to NADA.

Pros and Cons of Online Tools:

- Pros: Fast, objective, recognized by lenders.

- Cons: They don’t see your beautiful landscaping or your new kitchen. They only crunch raw numbers. Use this as a “floor” price, not the ceiling.

Get a Professional Appraisal

If you are still unsure, or if your home is on permanent foundation on your own land, hire a pro.

A manufactured home appraisal typically costs between $300 and $500. Ensure you hire an appraiser who specializes in manufactured housing. They will inspect the home, measure it, check the HUD tags, and pull professional comps.

When should you hire an appraiser?

- If you are selling the land and home together.

- If you have a unique property that is hard to compare to others.

- If you want a rock-solid price to show sceptical buyers.

Pro Tip: Create a “Value Folder” for potential buyers. Include your NADA report, a list of your upgrades (with receipts), and printouts of comparable sales. This documentation justifies your price better than any sales pitch.

Top Tools and Resources for Mobile Home Valuation

You don’t have to do this alone. There are digital tools designed specifically to help you determine the value of a mobile home. Here are the best ones available in 2026.

The “Big Three” Resources

- NADA Mobile Home Value Guide This is the industry standard. Banks use it; dealers use it. It works exactly like the Kelly Blue Book for cars. You input the make, model, year, and features, and it spits out a base value and an adjusted value.

- Best for: Getting a baseline financing number.

- MHVillage MHVillage is the Zillow of the mobile home world. Their “Sold Home” data is invaluable because it reflects what buyers are actually paying right now, not just theoretical book value.

- Best for: Seeing real-time market trends and local competition.

- Datacomp If you need a serious, bank-ready valuation, Datacomp is the nation’s largest provider of market-based manufactured home appraisals. It costs money, but it’s accurate.

- Best for: Sellers who need official documentation for high-value homes.

Tool Comparison Table

Tool NameCostAccuracy for Market PriceDifficulty Level

NADA Guides Low (approx $30-$50) High (for Book Value) Easy

Zillow / Trulia Free Low (Often inaccurate) Very Easy

Professional Appraisal High ($300-$500) Very High Requires Appointment

MHVillage Search Free Medium (Requires analysis) Medium

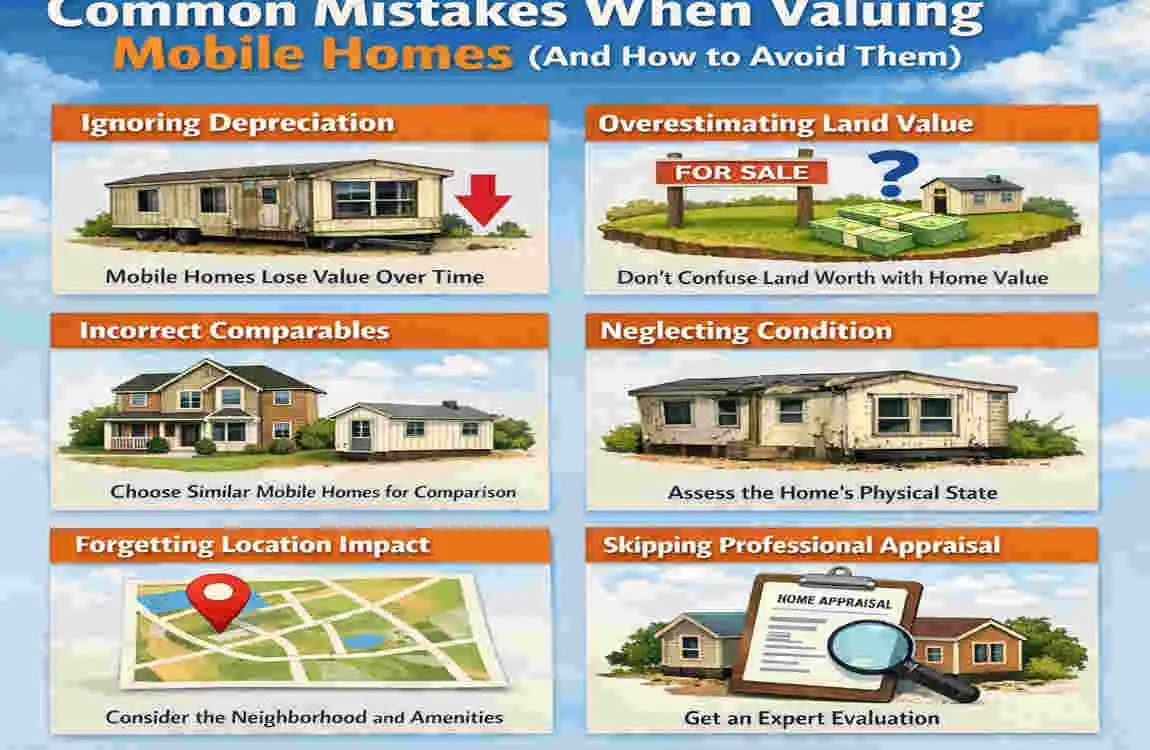

Common Mistakes When Valuing Mobile Homes (And How to Avoid Them)

I have seen sellers lose months because they fell into these traps. When trying to figure out how to value mobile home property, avoid these pitfalls.

Ignoring Park Transfer Fees and Requirements

Some parks require the new buyer to pay a transfer fee, or they may require the seller to perform specific upgrades (such as painting the skirting) before the sale is approved.

- The Fix: Read your lease. Talk to the park manager before you set your price. If you have to spend $2,000 on park-mandated repairs, factor that in.

Emotional Pricing (The Endowment Effect)

You raised your kids here. You remember the Christmas parties. That emotional value is real to you, but it is worth $0 to the buyer.

- The Fix: Stick to the data. If the comps say $60,000, do not list for $80,000 just because you “feel” it’s a good home.

Overlooking “Financiability”

If your home was built before 1976 or has been moved more than once, most banks will not lend on it. This means you need a cash buyer.

- The Fix: If you are limited to cash buyers, you generally have to lower the price. Cash buyers expect a discount for the liquidity they provide.

Forgetting the “Curb Appeal” Factor

You might have a palace on the inside, but if the vinyl siding is green with algae and the skirting is cracked, buyers will mentally deduct thousands of dollars before they even walk in the door.

- The Fix: Power wash the exterior. It is the cheapest way to add $1,000+ to your perceived value.

Real-Life Examples: Mobile Home Valuation Case Studies

Let’s look at two hypothetical examples based on real 2026 market data to see how this works in practice.

The Value of Upgrades (Florida)

Seller: Sarah Home: 2015 Double-wide in a 55+ Community. Initial Thought: She wanted to list for $90,000 because she paid $85,000. ** The Process:**

- She checked comps and saw similar units selling for $95,000.

- However, her unit had original carpet (worn) and old laminate countertops.

- Action: Sarah spent $3,000 on new luxury vinyl plank flooring and $500 on fresh paint.

- Result: She listed for $105,000 highlighting the “Move-in Ready” status.

- Sale: Sold for $102,000 in 14 days. Her $3,500 investment netted her a significant profit over her initial idea.

The Reality of Location (Ohio)

Seller: Mike Home: 2020 Single-wide on Leased Land. The Issue: Mike’s home was new, but the park had just raised lot rent to $750 (high for the area). The Process:

- NADA Book Value said the home was worth $55,000.

- Mike listed at $55,000. No bites for 2 months.

- Buyers kept saying, “The monthly payment with that lot rent is too high.”

- Adjustment: Mike had to accept that the high lot rent lowered his asset value.

- Result: He lowered the price to $48,000. It sold immediately to a cash buyer.

- Lesson: Market economics (monthly affordability) always win over book value.

Next Steps After Valuing Your Mobile Home

You have done the math. You have checked the comps. You have a number in your head. What now?

Set Your Strategic Price

If your valuation comes out to $78,000, consider listing at $79,900. It leaves a little room for negotiation but stays under the psychological $80k barrier. If you want a bidding war, price it slightly below the comps (e.g., $75,000).

Prep for Sale

Value is theoretical until a buyer sees it.

- Declutter: Remove 50% of your personal items. Make the rooms look huge.

- Staging: Ensure every room has a clear purpose.

- Lighting: Open all curtains and replace burnt-out bulbs. Bright homes sell for more money.

Consider Hiring a Specialist

Selling a mobile home involves specific paperwork (title transfer, bill of sale, park approval). If this feels overwhelming, look for a real estate agent who specializes in manufactured homes. Standard residential agents often don’t understand the nuances of this market.

Take Action: Don’t just sit on this information. Start by locating your Data Plate today. That one small step gets the ball rolling!

Frequently Asked Questions (FAQ)

Here are the most common questions sellers ask when determining the value of their mobile home.

How much is my mobile home worth?

There is no single number. Your home’s value is a combination of its age, condition, size (single vs double-wide), and, most importantly, its location (park vs private land). You must compare it to recently sold homes in your area to get an accurate figure.

Does location affect mobile home value?

Absolutely. It is the number one factor. A home in a highly desirable, well-managed community with amenities will sell for significantly more than the same home in a neglected park. Furthermore, homes on owned land generally appreciate, while homes on leased land rely heavily on the park’s market stability.

What is the difference between an appraisal and comps?

Comps (Comparables) are a look at what similar homes recently sold for; you can do this research yourself. An appraisal is a formal, written opinion of value provided by a licensed professional. Lenders usually require appraisals, while sellers use comps to set a listing price.

Can I value my mobile home for free?

Yes. You can use free resources like Zillow (for general market trends), MHVillage (to see asking prices), and local classifieds to estimate value. However, for a precise “Book Value,” you typically have to pay a small fee to NADAguides.

Do mobile homes lose value over time?

Not always. The old myth that “mobile homes depreciate like cars” is changing. While the structure itself can depreciate, well-maintained homes in high-demand areas (especially where housing is scarce) have seen value increases in recent years. If you own the land underneath the home, the property as a whole is very likely to appreciate.