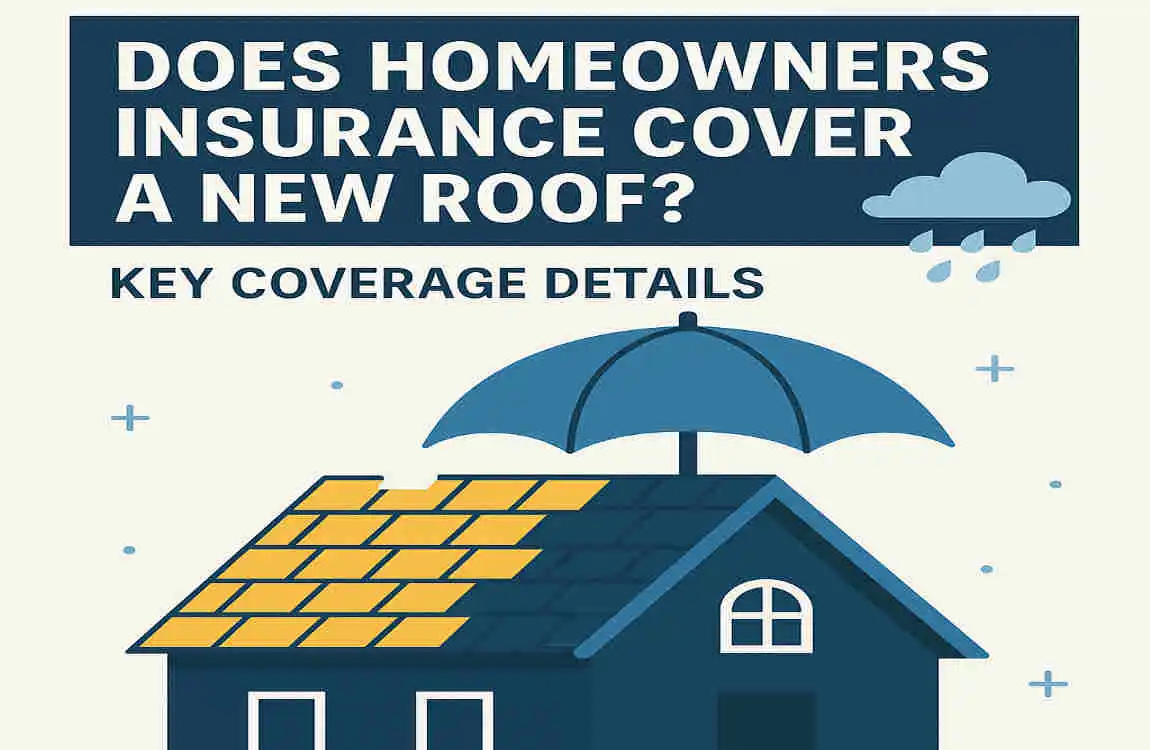

When a severe storm or unexpected disaster damages your roof, the costs of a replacement can feel overwhelming. But here’s the good news: your homeowners’ insurance can often cover the cost of a new roof, saving you thousands of dollars. The key is knowing how to navigate the process effectively.

Does Homeowners Insurance Cover a New Roof? Key Coverage Details

Understanding what your insurance policy covers is the foundation of a successful claim. While most standard homeowners’ insurance policies (often referred to as HO-3 policies) cover roof damage, there are important details to consider.

What is Covered?

Most homeowners’ insurance policies cover “perils,” or specific events that cause damage. Here are the most common perils that lead to roof claims:

- Windstorms and hail: These are among the top causes of roof damage.

- Fire damage: Insurance typically covers the cost of complete replacement after a fire.

- Falling objects: Tree branches or debris that damage your roof during a storm are usually covered.

- Vandalism: If someone intentionally damages your roof, it’s likely covered.

What is Not Covered?

However, there are several exclusions to be aware of. Insurance companies won’t pay for:

- Wear and tear: Age-related damage or lack of maintenance.

- Floods and earthquakes: These require separate riders or policies.

- Neglect: If your roof was already in poor condition before the damage occurred.

ACV vs. RCV: What’s the Difference?

When it comes to roof claims, your payout depends on whether your policy uses Actual Cash Value (ACV) or Replacement Cost Value (RCV):

Feature ACVRCV

Definition: Payout based on the depreciated value of your roof. Payout based on the full cost of replacing your roof.

Example A: A 15-year-old roof valued at $20,000 but depreciated to $8,000 would cost $8,000. The same roof would be replaced at the full $20,000 cost.

Best For Older roofs or basic policies. Newer roofs or policies for complete protection.

Pro Tip: Review your policy to determine whether you have ACV or RCV coverage. If you have ACV, you might receive less than the cost of a complete replacement.

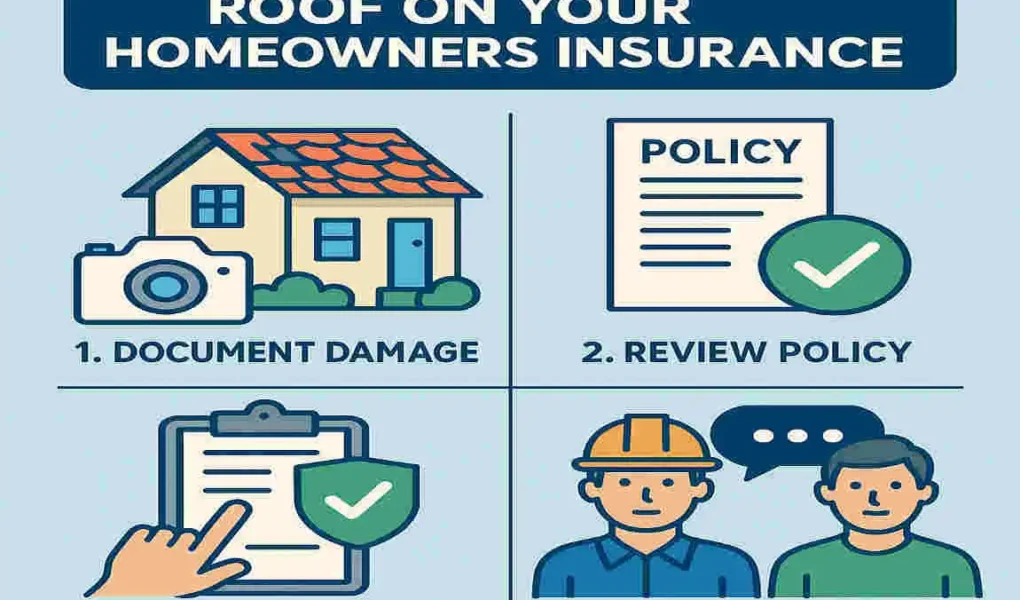

Step-by-Step Guide: How to Claim a New Roof on Your Homeowners Insurance

Here’s the heart of the process: a detailed, step-by-step guide to help you claim a new roof on your homeowners’ insurance. Follow these steps to ensure success.

Inspect and Document Roof Damage Immediately

After a storm or incident, your first step is to assess the damage. Safety comes first, so avoid climbing onto your roof if it’s unsafe to do so. Instead, hire a professional inspector if necessary.

- Document everything: Take clear, detailed photos and videos of the damage from multiple angles. Capture both expansive views and close-ups.

- Before-and-after evidence: If you have photos of your roof before the damage, use these to strengthen your claim.

This documentation is the foundation of your claim and helps you navigate the roof damage insurance claim process smoothly.

Review Your Homeowners Insurance Policy

Before filing your claim, review your policy to understand your coverage and deductible. Check the declarations page for key details such as:

- Roof coverage limits

- Deductible amounts (usually $1,000 to $5,000)

- Exclusions (e.g., age-related damage)

If anything is unclear, contact your insurance agent to clarify your coverage and confirm you can proceed with a claim.

File the Claim Promptly

Timing is critical when filing an insurance claim. Many insurers require claims to be filed within 24 to 72 hours of the damage occurring.

- How to file: Most companies offer online portals, mobile apps, or phone hotlines for filing claims.

- Information to provide: Include your policy number, a clear description of the damage, and your supporting evidence (photos, videos, etc.).

Work with the Insurance Adjuster

Once you file your claim, the insurance company will assign an adjuster to assess the damage. Here’s what to expect:

- Prepare your evidence: Have all your photos, videos, and receipts ready.

- Be present during the inspection: Walk the adjuster through the damage and answer any questions.

- Stay vigilant: Watch for signs that the adjuster may undervalue your claim or suggest repairs instead of a complete replacement.

Get Contractor Estimates for Roof Replacement

Before approving the settlement, get estimates from at least three licensed contractors. This ensures that you have a clear idea of the replacement cost and can compare it to the insurer’s offer.

Negotiate and Approve the Settlement

If the insurer’s initial offer is too low, don’t be afraid to negotiate. Use your evidence and contractor estimates to justify your request for a higher payout.

Complete the Roof Replacement and Close the Claim

Once you receive the settlement, hire a reputable contractor to replace your roof. Submit all receipts and documentation to your insurer to officially close the claim.

Common Mistakes to Avoid When Filing a Roof Insurance Claim

Even with a solid plan, mistakes can derail your claim. Here are some pitfalls to watch out for:

- Delaying your claim: Waiting too long can result in a denial.

- Poor documentation: Insufficient evidence weakens your case.

- Hiring unlicensed contractors: This can void your insurance coverage.

- Ignoring policy details: Missing depreciation clauses or exclusions can lead to surprises.

Pro Tips for a Successful New Roof Insurance Claim

Maximize your chances of success with these expert tips:

- Upgrade to RCV coverage: This ensures you receive the full replacement cost.

- Keep maintenance records: Regular roof inspections and repairs show you’ve taken good care of your roof.

- Use weather reports: These can help prove the timing and cause of damage.

- Consider a public adjuster: For complicated claims, a public adjuster can negotiate on your behalf for a fee (typically 10-15%).

How Long Does a Roof Insurance Claim Take?

Most roof insurance claims take 30 to 60 days to process, but this timeline can vary based on factors like:

- Adjuster availability

- The complexity of the damage

- Delays in submitting documentation

To speed up the process, respond to all insurer requests promptly and use digital submission methods whenever possible.