Discovering tiny holes in your wooden beams, accompanied by powdery dust, can be alarming. These are often signs of woodworm infestation, which can compromise the structural integrity of your home if left untreated. But here’s the big question: Is woodworm covered by house insurance?

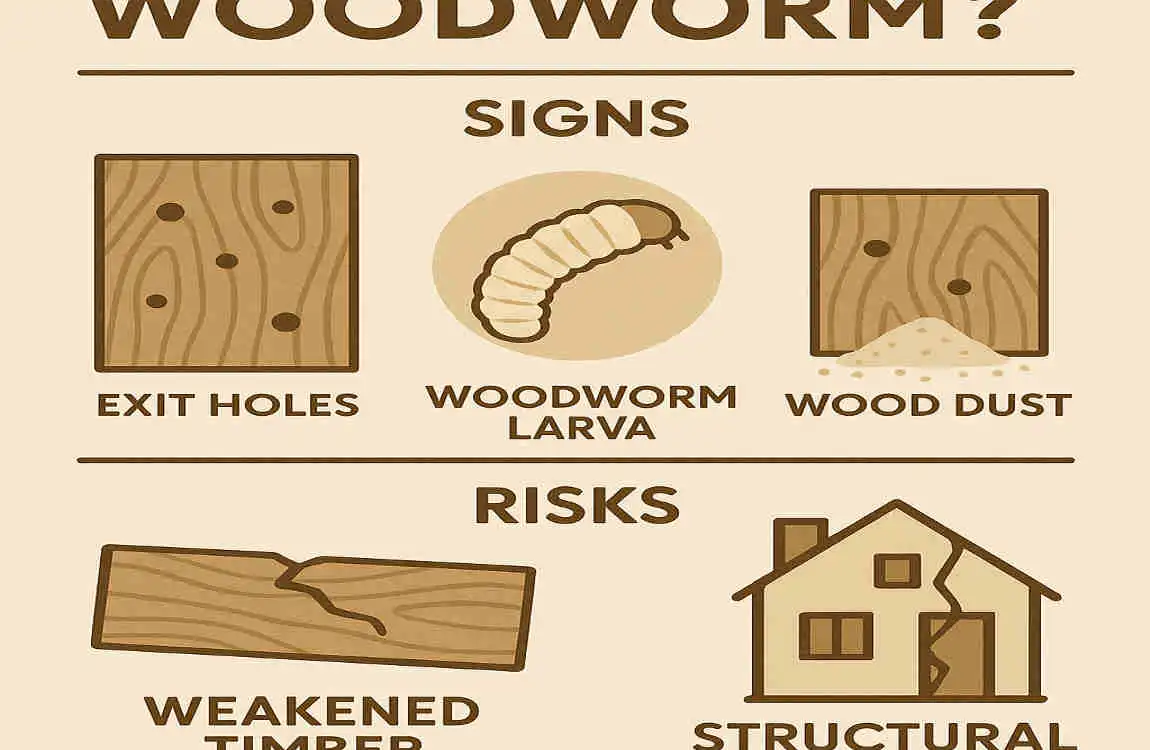

What is Woodworm? Signs & Risks

Woodworm refers to the larvae of wood-boring beetles that burrow into timber, feeding on it and leaving weakened structures behind. While the term may sound harmless, woodworm infestations can cause significant and costly damage to your home if left untreated.

How to Identify Woodworm

Early detection is key to preventing severe damage. Here are the common signs of a woodworm infestation:

- Small Exit Holes: Tiny round holes (1-2mm in diameter) on the wood surface, indicating where adult beetles have exited.

- Powdery Frass: Fine, sawdust-like powder around affected areas, caused by wood-boring activity.

- Crumbly or Weak Wood: Wood that feels soft or breaks apart easily is a clear sign of severe infestation.

- Tapping Sounds: In rare cases, you may hear faint tapping as larvae feed on the wood.

Commonly Affected Areas

Woodworm can infest various parts of your home, but certain areas are particularly vulnerable:

- Floorboards

- Roof beams and loft timbers

- Furniture

- Wooden window frames and door frames

The Risks of Untreated Woodworm

If left unchecked, woodworm infestations can lead to significant structural issues. Over time, the affected wood may weaken to the point where it compromises the integrity of your home. Here’s a quick overview:

Sign Description Urgency Level

Exit Holes Small round holes (1-2mm) High

Frass, Powdery dust piles, Medium

Wood Crumble Soft, weakened timber Critical

Ignoring these signs could result in repair costs ranging from £500 to over £5,000!

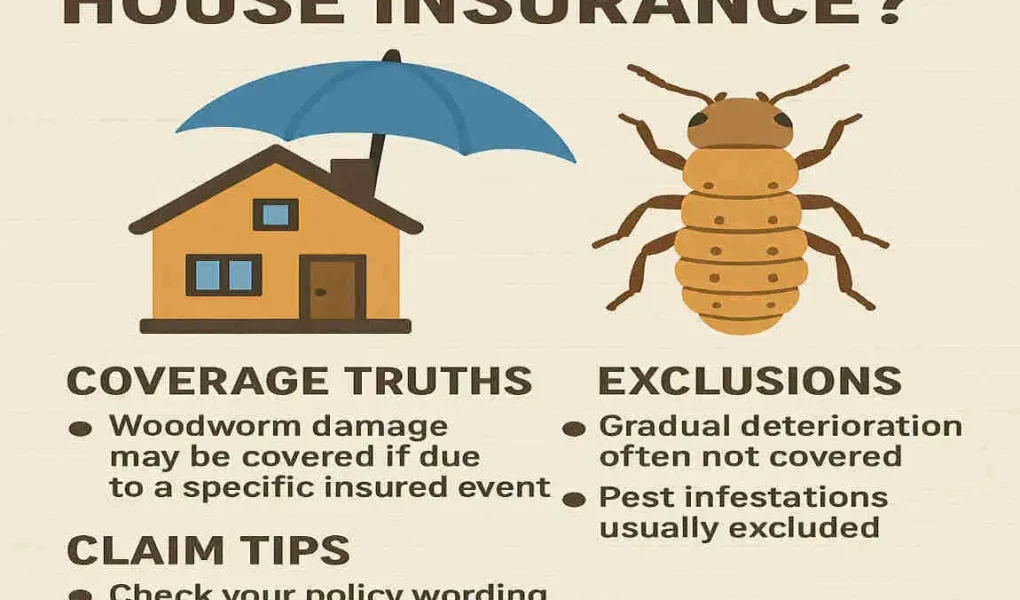

Does House Insurance cover Woodworm? The Truth

The harsh reality is that most standard home insurance policies do not cover woodworm damage. Insurers typically classify woodworm infestations as a “maintenance issue” or “gradual deterioration”—both of which are excluded from coverage.

Why Do Insurers Exclude Woodworm?

Home insurance is designed to cover sudden and unforeseen events, such as fires, floods, and storms. Woodworm, however, is seen as a preventable problem that develops over time due to neglect or poor maintenance. As a result, insurers argue that it’s the homeowner’s responsibility to prevent and treat infestations before they cause damage.

Are There Any Exceptions?

In some specific cases, you may find limited coverage for woodworm damage. These include:

- Add-On Pest Coverage: Some insurance providers offer optional pest coverage, including woodworm. However, this is rare and usually comes at an additional cost.

- Damage Linked to an Insured Event: If the woodworm infestation resulted from an insured event—such as a burst pipe causing damp conditions—it’s possible (though not guaranteed) that related repairs may be covered.

Insurer Comparison Table

Here’s a comparison of how major UK insurers handle woodworm coverage:

Insurer Covers Wood worm? Notes

AA No Classified as “wear and tear”.

AXA No Explicitly excludes pest-related damage.

Allianz Partial Covers emergencies like bees/wasps—not woodworm.

Generic Providers Add-on Possible. Check individual policies for pest clauses.

Pro Tip: Always review your policy documents, especially the sections on “vermin” or “gradual damage” exclusions.

Standard Exclusions & Policy Fine Print

When it comes to woodworm, insurance exclusions and fine print are where most homeowners get caught off guard. Understanding these exclusions can save you from unpleasant surprises.

Why Woodworm Isn’t Typically Covered

Here are the common reasons insurers deny coverage for woodworm:

- Insects/Vermin Exclusion: Woodworm is often grouped under “vermin,” which most policies exclude.

- Gradual Damage: Insurers classify woodworm as a gradual issue rather than a sudden, insurable event.

- Neglect or Poor Maintenance: If the infestation is deemed preventable, you won’t be covered.

Policy Traps to Watch Out For

- Pre-Existing Infestations: If the woodworm was present before you took out the policy, your claim will likely be denied.

- Prevention Costs: Insurance won’t cover the cost of preventive treatments or inspections.

- Excess Fees: Even if a claim is approved, you may face excess charges starting at £200 or more.

What Might Be Covered Instead

While woodworm itself isn’t covered, related damages might qualify. For example:

- Repairs caused by sudden water damage that led to damp wood, which attracted woodworm.

Tip: Thoroughly review the “perils covered” section of your policy and use comparison tools like MoneySuperMarket to find policies with better inclusions.

How to Make a Woodworm Insurance Claim

If you believe your policy covers woodworm damage, here’s a step-by-step guide to improve your chances of a successful claim.

Step-by-Step Guide

- Document Evidence: Take clear photos of the affected areas, including any frass or exit holes.

- Hire a Professional Surveyor: Obtain a detailed report from a PCA-accredited surveyor, such as Timberwise. This will cost £200-£400 but is essential for your claim.

- Notify Your Insurer: Contact your insurer within 7 days of discovering the damage. Submit the survey report along with your claim.

- Await Approval: Be prepared for scrutiny. Insurers will investigate whether the damage was preventable or caused by neglect.

Key Documents for Your Claim

Document Purpose

Photos/Frass: Visual proof of damage

Survey Report Expert diagnosis

Policy Documents Proof of coverage

Caution: Filing a false claim or providing insufficient evidence may result in policy cancellation.

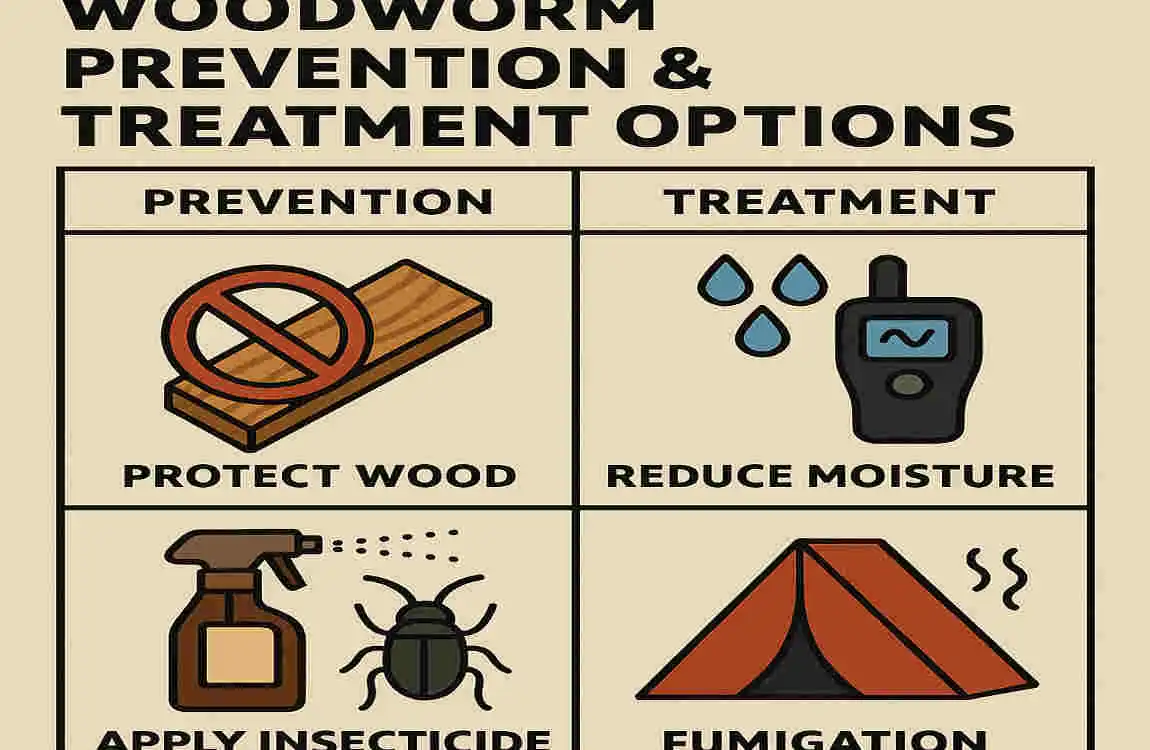

Woodworm Prevention & Treatment Options

Since woodworm is rarely covered by insurance, prevention is your best defense. Here’s how to proactively protect your home.

Prevention Tips

- Control Moisture: Fix any leaks and ensure proper ventilation in lofts and basements.

- Inspect Regularly: Annual inspections can help catch woodworm early before it spreads.

- Treat At-Risk Areas: Apply woodworm treatments to vulnerable timber, especially in damp environments.

Treatment Options

Method Cost Range Best For

DIY Spray £20-£100 Small furniture or items

Professional Injection £500-£2,000 Beams and larger areas

Heat Treatment £1,000+ Severe infestations

For severe cases or structural timber, hiring professionals is highly recommended. Professional treatments often come with warranties lasting up to 20 years.

When to Call Professionals

For large-scale infestations or structural damage, always hire a professional. DIY methods may not penetrate deeply enough to eliminate larvae within beams.

FAQs

Is woodworm covered by house insurance?

Rarely. Check your policy’s exclusions for “vermin” or “gradual damage.”

Does contents insurance cover woodworm?

Typically, no. Woodworm affecting furniture or belongings is usually excluded.

How much does woodworm treatment cost?

Costs range from £20 for DIY sprays to over £3,000 for professional treatments.