Remortgaging your home for business financing involves replacing your existing mortgage with a new one, often to access the equity tied up in your property. This equity can then be used as capital to start or expand a business, offering a potentially lower interest rate compared to other types of borrowing. The process involves assessing your business home‘s value and equity, consulting with a mortgage advisor, researching lenders, submitting an application with the necessary documentation, and completing legal and valuation steps. While this approach offers significant capital and flexible use of funds, it also carries risks, including the potential to put your home at risk if repayments are missed and committing to a long-term financial obligation.

Understanding Remortgaging and Its Benefits

Remortgaging refers to the process of replacing your existing mortgage with a new one, often to secure better terms or lower interest rates. This financial maneuver can unlock significant equity in your home, offering a fresh source of funding.

One of the primary benefits is accessing cash without selling your property. Homeowners can tap into their equity to finance business ventures while keeping their homes intact.

This extra cash flow can be redirected towards business investments or operational costs.

Moreover, the flexibility in repayment plans allows you to choose options that best suit your financial situation and growth aspirations. With thoughtful planning and strategic use of funds, remortgaging could become an invaluable asset for fueling entrepreneurial dreams.

Factors to Consider Before Remortgaging for Business Financing

Before deciding to remortgage for business financing, take a close look at your current financial situation. Assess your income stability and cash flow. This insight will help you determine if you can handle higher repayments.

Next, consider the amount of equity in your home. A strong equity position enhances borrowing potential but also carries risks if property values fluctuate.

Evaluate interest rates available in the market. Compare different lenders and their offers to ensure you’re getting competitive terms.

Don’t overlook potential fees associated with remortgaging. Application costs, valuation fees, or early repayment charges from your existing lender can add up quickly.

Reflect on the purpose of the funds. Understand how this investment aligns with your overall business strategy and growth plans before committing to a new loan structure.

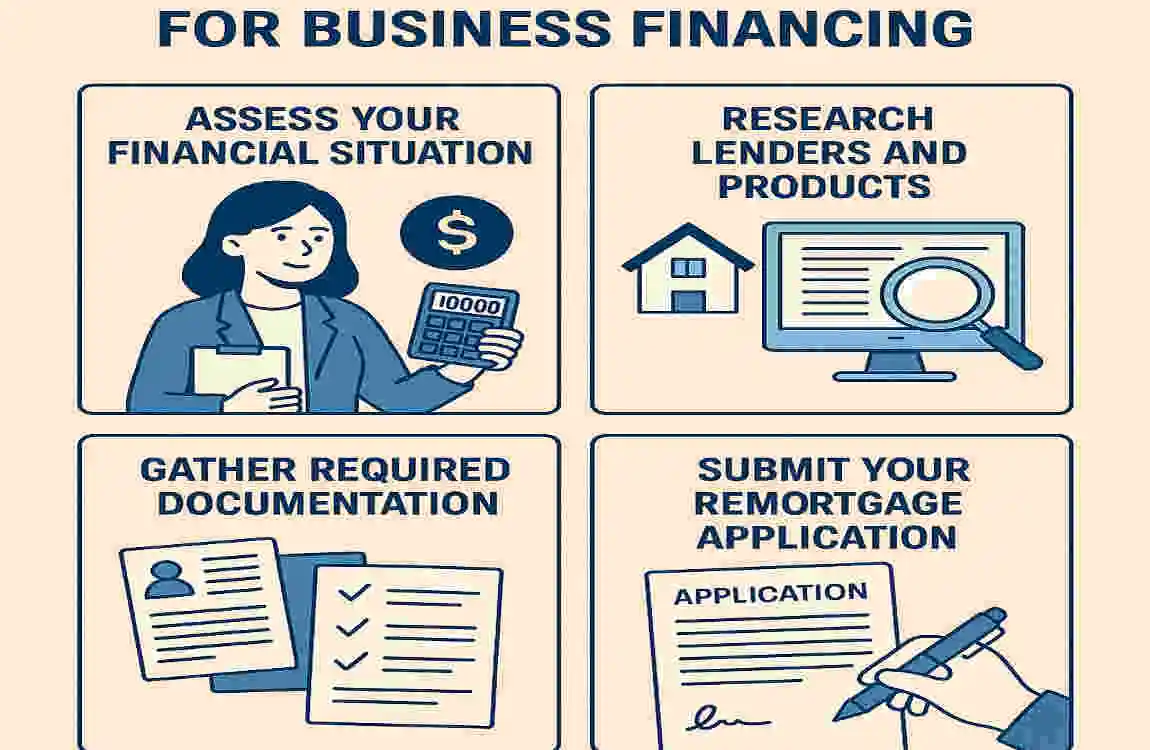

Steps to Take When Remortgaging for Business Financing

Start by assessing your current mortgage terms. Identify the interest rate, remaining balance, and any penalties for early repayment. This information is crucial for making informed decisions.

Next, determine how much equity you have in your home. Calculate the difference between your home’s market value and what you owe on it. The more equity you possess, the better financing options available to you.

Research potential lenders that offer remortgaging specifically for business purposes. Look for those with favorable terms and competitive rates tailored to entrepreneurs.

Gather necessary documentation such as proof of income, business plans, and credit history. Lenders will require this information to assess your financial health.

Consult a mortgage advisor if needed. They can provide valuable insights into navigating the process smoothly and identifying suitable loan products that align with your needs.

Top Lenders that Offer Remortgaging for Business Purposes

When considering remortgaging for business financing, choosing the right lender is crucial. Several lenders specialize in this area, providing tailored solutions that fit your unique needs.

Nationwide building societies often offer competitive rates and flexible terms. They offer customized packages tailored for small businesses looking to effectively utilize their real home business equity.

Another noteworthy option is HSBC. Their remortgage products can accommodate various business types, making them an excellent choice for entrepreneurs with diverse needs.

Santander also provides attractive deals for those seeking to use their homes as collateral. Their customer service is renowned for being responsive and helpful throughout the application process.

Consider specialist lenders like Aldermore or Shawbrook Bank. They focus on niche markets and understand the challenges of securing finance through property assets. These institutions could offer a more personalized approach than traditional banks.

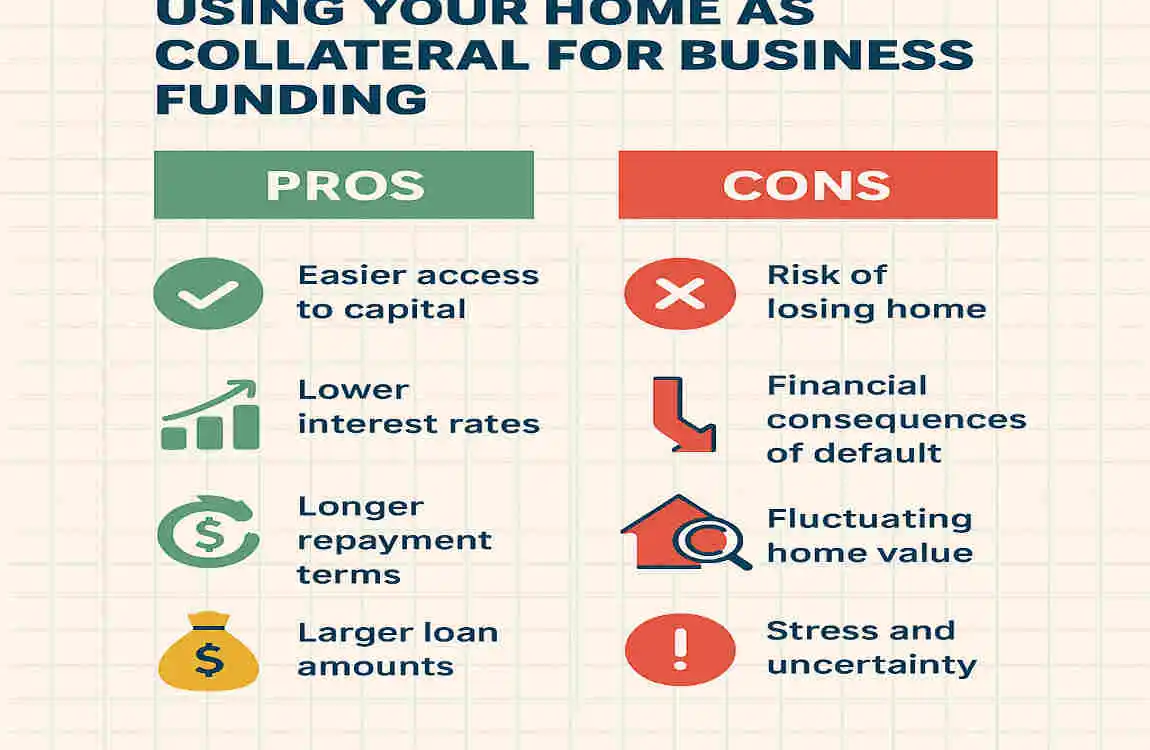

Pros and Cons of Using Your Home as Collateral for Business Funding

Using your home as collateral for business funding has distinct advantages. It often leads to lower interest rates compared to unsecured loans. The equity in your property can provide substantial financing, which is essential for growth or urgent needs.

However, there are significant risks involved. If the business fails and you can’t repay the loan, you might lose your home. This adds a layer of stress that could affect both personal and professional life.

Moreover, leveraging your property can limit future borrowing options. Lenders may view it as a risky move if they see you’re already using assets for financing.

Understanding these pros and cons is crucial before making any decisions about remortgaging your home for business purposes. Each situation varies considerably based on individual circumstances and market conditions.

Can I Remortgage My House to Buy a Business? FAQ

Yes, you can remortgage your house to buy a business, but whether you should depends on your financial situation, risk tolerance, and lender requirements. Here are quick answers to the most common questions:

Is it allowed to use a remortgage for buying a business?

Yes. Many lenders allow you to release equity from your home and use the funds for business purposes.

Will every lender approve this?

No. Some lenders consider business purchases high‑risk and may refuse. You may need a specialist lender or broker.

Do I need a business plan for the application?

Usually yes. Lenders often want:

- A solid business plan

- Cash flow projections

- Proof the investment is viable

Will I need to pay higher interest rates?

Possibly. Remortgaging for business purposes can come with slightly higher rates because of added risk.

How much equity do I need?

Typically 20–25% equity minimum, but more equity improves your chances.

Does remortgaging affect my credit?

Yes. It shows as new credit and increases your mortgage balance, which may impact your credit rating.

Is this risky?

Yes. If the business fails, your home is still at risk because it’s tied to the loan.

Do I need legal or financial advice?

Highly recommended. A mortgage broker, accountant, or financial adviser can help you avoid serious risks.

Can I use a buy‑to‑let mortgage instead?

Usually no. Buy‑to‑let mortgages have strict rules and typically don’t allow business purchases.

Is this a good idea?

It can be, but only if:

- The business is stable

- You can afford the repayments

- You understand the risks to your home