Home security systems are generally not tax-deductible for most homeowners when used strictly for personal protection. However, tax deductions may be possible if the security system is used for business purposes, such as protecting a home office or a rental property that serves as a principal place of business. In such cases, only the portion of the security system expenses related to business use can be deducted. Proper documentation and careful allocation of costs are essential to qualify for these deductions. Consulting a tax professional is recommended to navigate IRS rules and ensure compliance.

Understanding the Tax Benefits of Home Security Systems

Home security systems offer more than just peace of mind. They can provide tangible financial benefits, particularly when it comes to taxes.

Many homeowners might not realize that certain expenses related to these systems could qualify for tax deductions. The key lies in understanding the eligibility criteria and potential savings.

For instance, if your home office is equipped with a security system, you can deduct associated costs as business expenses. This includes installation fees and monthly monitoring charges.

Some states even incentivize home security measures through tax credits or rebates. These programs aim to promote safety within communities while providing financial relief for residents investing in their protection.

Exploring these avenues can make a significant difference come tax season, allowing you to maximize your return while safeguarding your property.

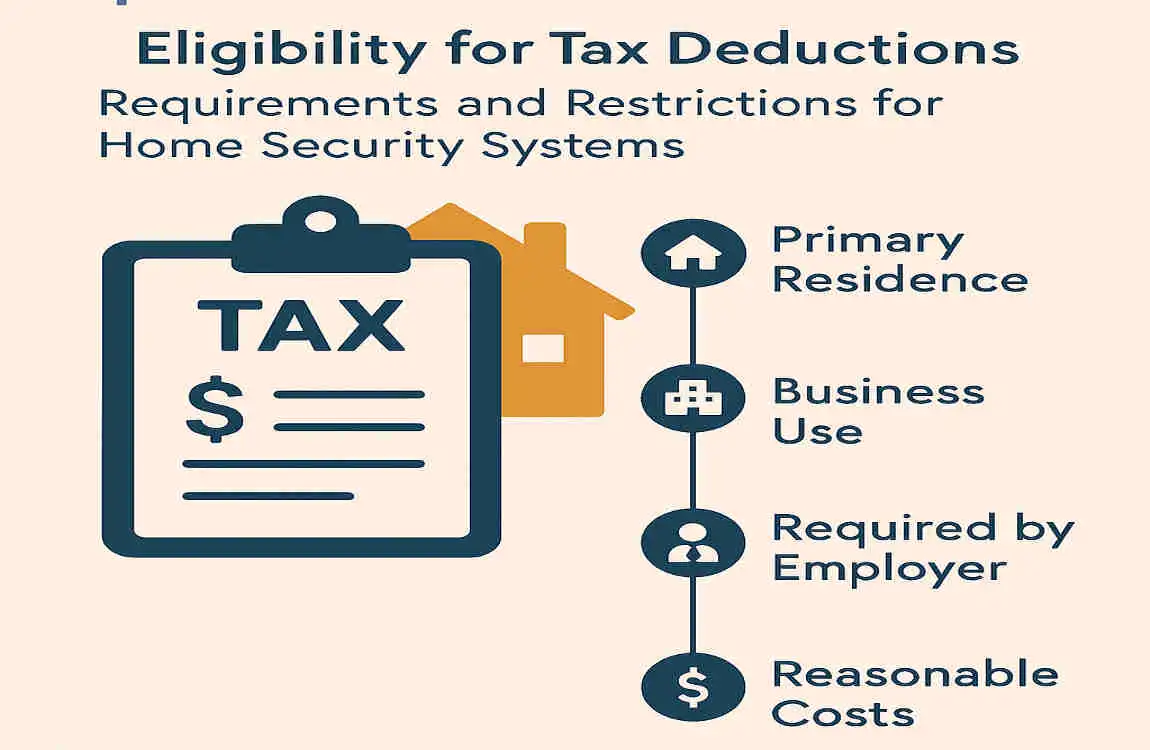

Eligibility for Tax Deductions: Requirements and Restrictions

To qualify for tax deductions related to home security systems, several key criteria must be met. First, the installation should enhance the safety of your primary residence. This means you can’t claim costs if it’s just a luxury addition.

Second, ensure that your system is professionally installed or equipped with monitoring services. DIY installations may not always meet IRS guidelines for deductions.

Homeowners need to consider the purpose behind their security measures as well. If it’s strictly for personal use, it typically won’t qualify. However, if you run a business from home and can demonstrate that your system protects work-related assets, there might be deduction opportunities.

Keep in mind that tax laws frequently change. It’s wise to consult current regulations or a tax professional before proceeding with any claims regarding these expenses.

Documentation Needed for Claiming Home Security System Tax Deductions

When it comes to claiming tax deductions for your home security system, proper documentation is key. Start by keeping all purchase receipts. This includes the cost of the equipment, installation fees, and any maintenance charges.

Next, gather invoices that detail these expenses. They should clearly outline what services were provided and when they occurred. If you hired a professional service for installation or monitoring, ensure you have records of those payments as well.

Don’t forget about warranties or agreements with your security provider. These can support claims regarding ongoing costs associated with maintaining your system.

If applicable, maintain records showing how the security measures relate to business use if you’re eligible for that deduction aspect. Having organized documents will streamline the process come tax season and increase your chances of a successful claim.

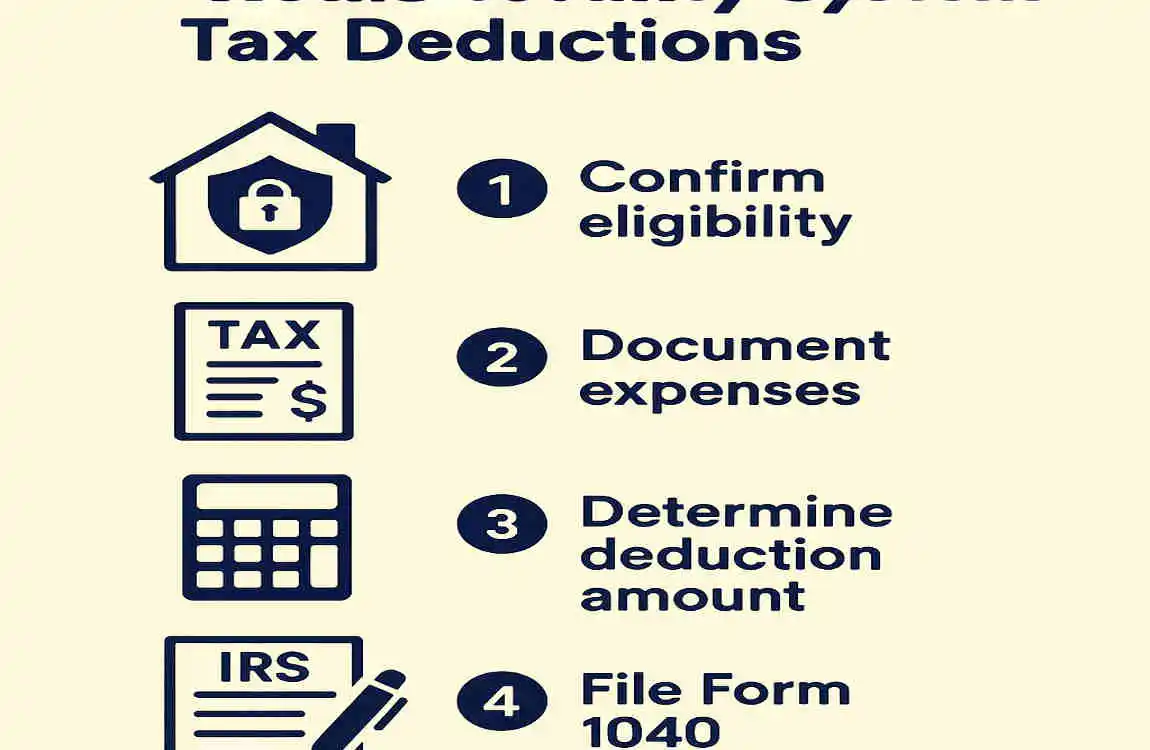

How to Claim Home Security System Tax Deductions

Claiming tax deductions for your home security system is a straightforward process, but it requires careful attention to detail. First, ensure you have the necessary documentation in hand.

Gather receipts that show the purchase price of the equipment and installation costs. If you’ve made upgrades or ongoing monthly payments, keep records of those as well.

When tax season arrives, report these expenses on your Schedule A if you’re itemizing deductions. Be sure to know which part of your home qualifies—often, only specific areas are eligible if used for business purposes.

Consult with a tax professional who can provide clarity on any nuances regarding deductions related to personal versus rental properties. They can also determine how much you can deduct based on regulations in your state or locality.

FAQ: Are Home Security Systems Tax Deductible?

Q: Can I deduct the cost of a home security system on my taxes?

A: For most homeowners, home security systems are not tax deductible if used for personal residences.

Q: Are there exceptions where I can claim a deduction?

A: Yes! If you have a home office that qualifies as a business expense, you might deduct a proportional part of your security system cost related to that space.

Q: What about rental or business properties?

A: For rental homes or commercial properties, security system expenses can usually be deducted as a business or rental expense.

Q: Does installation count, or just equipment?

A: Both equipment and installation fees may be deductible if they qualify under business or rental use.

Q: Should I consult a tax professional?

A: Absolutely! Tax laws can be complex, and a professional can help you understand what applies to your unique situation.