It’s a Tuesday evening. You’ve just finished a long day at work, and you step out into your backyard to catch a breath of fresh air. But instead of the scent of blooming jasmine or fresh cut grass, you are hit with a smell that can only be described as a mixture of rotten eggs and regret. You look down, and your worst nightmare is bubbling up from the ground—a soggy, smelly mess right where your septic tank is buried.

Panic sets in. You do the mental math. A full septic failure can cost upwards of $10,000 to $20,000. Your first thought, after grabbing the phone to call a plumber, is likely: Does house insurance cover septic tanks?

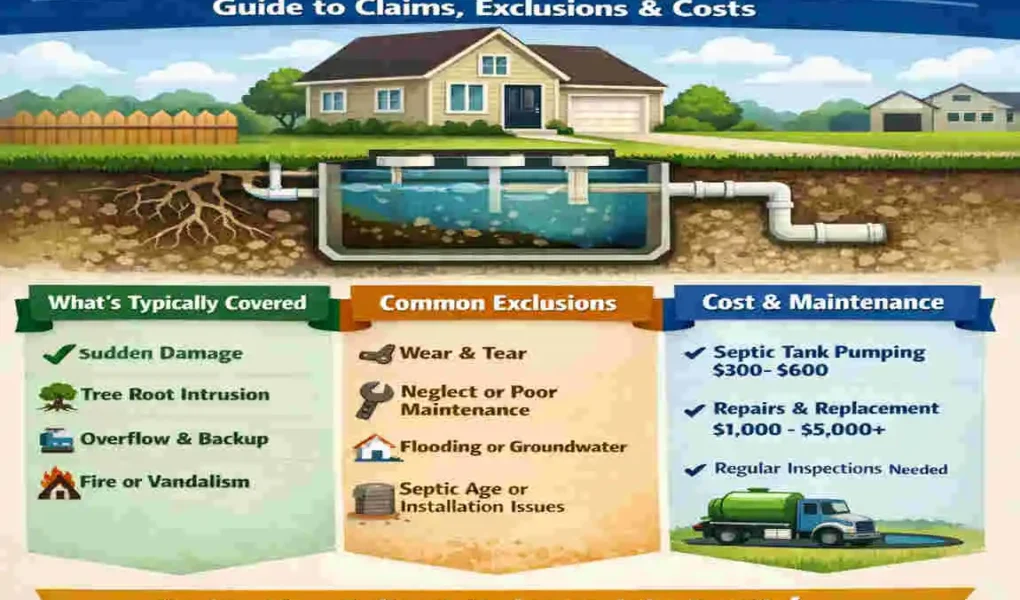

Generally speaking, standard homeowners’ insurance policies offer limited coverage for septic systems. If the damage is sudden and accidental—like a vehicle driving over the tank or a pipe bursting due to an unexpected freeze—you might be in luck. However, if the damage is caused by wear and tear, lack of maintenance, or simply the age of the system, you are likely on your own.

What Is a Septic Tank and Why Insurance Matters

Before we dive into the nitty-gritty of insurance policies, let’s get on the same page about what a septic system actually is. Understanding how it works is crucial because how it breaks determines if you get paid.

Think of your septic system as a personal, underground wastewater treatment plant. It is a marvel of engineering that uses biology and gravity to handle your home’s waste. It typically consists of three main parts:

- The Tank: A watertight box (usually concrete or fiberglass) buried in your yard. It holds the waste long enough for solids to settle to the bottom (forming sludge) and oil and grease to float to the top (scum).

- The Drain Field: This is a shallow, covered excavation made in unsaturated soil. Pretreated wastewater is discharged through piping onto porous surfaces that allow wastewater to filter through the soil.

- The Soil: The soil provides the final treatment by removing harmful bacteria, viruses, and nutrients.

Why They Are Prone to Failure

These systems are robust, but they are not invincible. They deal with harsh conditions 24/7. Common reasons for failure include:

- Clogs: Flushing things that shouldn’t be flushed (like “flushable” wipes, which typically aren’t).

- Tree Roots: Roots seek water, and your pipes are full of it. They can invade tiny cracks and shatter pipes.

- Soil Issues: If the ground becomes too saturated (like during a flood), the drain field stops working.

The Insurance Connection

Here is where it gets tricky. Most standard homeowners policies (often called HO-3 policies) categorize your property. Your house is the “Dwelling.” Your detached garage or shed is an “Other Structure.”

Septic tanks usually fall under “Other Structures.”

While your main dwelling might be covered for a wide range of disasters, coverage for “Other Structures” is often capped at a percentage of your total policy limit (usually 10%). Furthermore, the pipes connecting the tank to your house might be considered part of the dwelling, while the tank itself is separate. This distinction matters when you are fighting for a claim payout.

Does House Insurance Cover Septic Tanks? The Short Answer

If you are skimming this article looking for a simple “Yes” or “No,” you might be disappointed because insurance loves the gray areas. However, we can simplify it based on the cause of the damage.

The golden rule of insurance is: Is the damage sudden and accidental?

If the answer is yes, you have a fighting chance. If the answer is no (meaning the damage happened over months or years), the claim will likely be denied.

Here is a quick breakdown to help you visualize your odds:

Scenario Covered Typical Policy Limit

Sudden pipe burst Yes (if sudden/accidental) $5,000 – $20,000 (under Dwelling/Other Structures)

Wear-and-tear failure. No Excluded completely

Flood damage Sometimes Requires a separate Flood Endorsement

Neglect/Clogs are not considered a maintenance responsibility

Vehicle Impact : Yes , covered if a vehicle drives over and cracks the tank

Tree Root Intrusion Rarely Often viewed as a preventable/maintenance issue

The “Sudden and Accidental” Requirement

Most standard HO-3 policies are designed to protect you from catastrophes, not the inevitable aging of your home.

Let’s look at a real-world example. A homeowner in Texas recently discovered sewage backing up into their bathtub. The plumber found that tree roots had slowly crushed the line over five years. The insurance claim was denied. Why? because roots grow slowly. The insurer argued this was a maintenance issue that could have been caught with regular inspections.

However, another homeowner in a cold climate had a pipe freeze and shatter overnight during a record-breaking winter storm. That claim was approved. The difference? One was a slow process; the other was a sudden event.

What Septic Tank Damage Does Home Insurance Typically Cover?

Now that we know the “Sudden and Accidental” rule, let’s explore exactly which perils (that’s insurance-speak for “dangers”) are usually covered. While every policy is different, most standard providers will write checks for the following situations:

Fire and Explosions

It’s rare, but methane gas can build up in septic tanks. If an ignition source comes into contact with the gas, the tank can explode. Alternatively, if a wildfire or house fire damages the area above the tank and compromises its structural integrity, this is almost always covered.

Vehicle Impact

This is more common than you think. Delivery trucks, construction equipment, or even a guest parking on your lawn can drive over the buried tank. If the weight cracks the lid or collapses the tank, your “Other Structures” coverage should kick in.

Freezing Weather

If you live in a colder climate, a sudden deep freeze can cause the water in your pipes or even the tank to expand and crack the concrete or PVC. This is generally covered, provided you maintained heat in the home (insurers won’t pay if you turned off the heat and left for a month).

“Escape of Water.”

Some policies have specific clauses for the “sudden and accidental escape of water.” If a pipe snaps and pours water into the drain field, ruining it instantly, this clause might save you.

Step-by-Step Claim Example

Let’s walk through how a successful claim usually looks to help you understand the flow:

- Discovery: You notice a sinkhole forming in the yard after a heavy construction truck turned around in your driveway.

- Immediate Action: You verify the tank lid is cracked. You call the insurance company immediately.

- The Adjuster: An adjuster comes out. They see the tire tracks and the fresh damage. They agree it was “Sudden and Accidental.”

- The Payout: The adjuster calculates the cost to replace the tank lid and pump the tank. They write a check for the repairs, minus your deductible.

LSI Note: This is the ideal scenario for a septic tank leak insurance claim. However, getting to this point requires you to be very clear about how the damage happened.

Common Exclusions: When Insurance Won’t Cover Your Septic Tank

This section is the most important part of the article. It is better to know the bad news now than when you are standing in a puddle of sewage. Insurance companies are businesses, and they have strict lists of things they will not pay for.

Here are the top exclusions you need to watch out for:

Normal Wear and Tear

Nothing lasts forever. A concrete septic tank has a lifespan of about 40 years. A steel tank might only last 20 years. If your tank crumbles simply because it is old, your insurer will call this “wear and tear.” They view replacing an old tank the same way they view replacing an old roof—it is a cost of homeownership, not an insurance claim.

Lack of Maintenance

If you haven’t pumped your tank in 10 years and the sludge builds up, flows into the drain field, and ruins it, that is considered neglect. Insurers will ask for maintenance records. If you can’t prove you took care of the system, they likely won’t pay for the failure.

Earth Movement

Standard policies exclude damage from earthquakes, sinkholes, and landslides. If the ground settles and shears your septic pipes, you are usually out of luck unless you have a specific “Earth Movement” rider.

Flooding from Natural Disasters

This is a huge misconception. Standard home insurance does not cover flood damage. If a river overflows or heavy rains flood your property and fill your septic tank with silt, destroying the system, your standard policy pays nothing. You would need a separate policy through the National Flood Insurance Program (NFIP) or a private flood insurer.

Sewer Backup (Without Endorsement)

Many homeowners assume that if sewage backs up into the house, it is covered under their homeowners’ insurance policy. It is often not. Most basic policies exclude “backup of sewers and drains.” You usually have to pay extra for this specific coverage.

The Florida Exclusion

Consider a recent case in Florida. After a hurricane, a homeowner faced a $20,000 repair bill because floodwaters saturated the homeowner’s drain field, rendering it unusable. They filed a claim with their home insurer. Denied. They filed with their flood insurance. Denied (under a specific clause regarding ‘systems in the ground’). The homeowner had to pay out of pocket because they didn’t have the specific “Service Line” add-ons.

Step-by-Step Guide: Filing a Septic Tank Insurance Claim

If you suspect you have a valid claim (something sudden happened), you need to move fast and be precise. The difference between an approval and a denial often comes down to how you document the event.

Follow these steps to maximize your chances:

Document Everything Immediately

Before you clean anything up (unless it’s a health hazard), take pictures. Take a video.

- Photograph the damage to the yard.

- Photograph the backup inside the house.

- If a vehicle hits the tank, photograph the tire tracks.

- Do not throw away damaged parts until the adjuster sees them.

Mitigate Further Damage

Insurance policies require you to prevent the situation from getting worse.

- Shut off the main water valve to the house to prevent water from entering the tank.

- Call a professional plumber or septic company to stop the immediate flow.

- Important: Tell the plumber to “stop the leak,” but do not authorize full repairs until the insurance adjuster has seen it. If you fix it completely before they arrive, they won’t be able to verify the cause.

Notify Your Insurer

Call your agent or the claims hotline within 24 to 48 hours. Be factual.

- Say: “A pipe burst suddenly.”

- Do not say: “I think my old pipes finally gave up.” (That implies wear and tear).

- Stick to the facts of the event.

Get Professional Opinions

Don’t rely solely on the insurance adjuster’s opinion. Get 2 or 3 quotes from licensed septic contractors. Ask them to write a report detailing the cause of the failure if their report says “damage caused by sudden impact,” that is gold for your claim.

The Adjuster Meeting

Walk through the property with the adjuster. Show them your contractor’s report. If they deny the claim, ask for the specific policy language they are using to support their denial. You have the right to appeal.

Pro Tip: Keep Your Records

We cannot stress this enough. Keep a folder (digital or physical) with receipts for every time you have had the tank pumped or inspected. If you can prove the system was in good health before the accident, it is much harder for them to claim “neglect.”

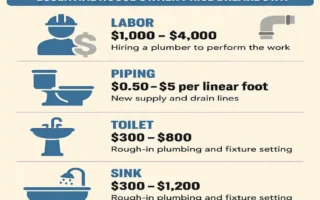

Septic Tank Repair and Replacement Costs Without Insurance

If the insurance company denies your claim—or if you realize your deductible is higher than the repair cost—you need to know what you are facing financially.

Prices have risen significantly over the last few years. Here is a breakdown of average costs for 2026. Note that these can vary wildly depending on where you live. A repair in a rural area might be cheaper than one in a high-cost-of-living suburb.

IssueAvg. Cost (2026)Insurance Impact

Pump-out & Inspection $300 – $500 Rarely covered (considered maintenance).

Minor Repair (Baffle/Pipe) $1,000 – $5,000 Partial coverage possible if sudden.

Distribution Box Replacement $1,500 – $3,500 Rarely covered unless damaged by impact.

Full Tank Replacement $5,000 – $20,000+ Coverage limited by “Other Structures” cap and deductibles.

Drain Field Replacement $10,000 – $30,000 Rarely covered; this is the most expensive fix.

Engineered/Sand Mound System $25,000 – $50,000 . Specialized systems cost significantly more.

Regional Variations

Construction costs vary globally. For readers in the U.S., labor rates are the biggest driver of cost. However, for markets like Pakistan (Punjab/Lahore), costs are driven more by material prices (concrete and piping), though groundwater issues in specific regions can require more expensive, reinforced tank designs.

The Inflation Factor

Since 2025, the cost of concrete and PVC piping has risen by roughly 15%. If you are budgeting for a replacement based on a quote your neighbor got three years ago, you need to update your math. It is always smart to keep an emergency fund specifically for home repairs like this.

How to Get Better Coverage: Riders, Endorsements & Alternatives

If standard insurance leaves a lot of gaps, how do you protect yourself? The answer lies in Endorsements (also called Riders). These are extra mini-policies you add to your main insurance for a small yearly fee.

They are worth every penny.

Service Line Coverage

This is the most important add-on for septic owners.

- What it does: It covers the cost of repairing underground pipes (water, sewer, septic) that are damaged by wear and tear, rust, or even tree roots.

- Cost: Usually cheap, around $50-$70 per year.

- Coverage Limit: Typically provides $10,000 to $20,000 in coverage. This often covers the “gap” that standard policies miss.

Water Backup and Sump Pump Overflow

- What it does: If your septic backs up and floods your basement, this covers the cleanup, new flooring, and replacement of damaged furniture.

- Cost: roughly $30 to $100 per year, depending on the limit you choose.

- Why get it: Standard policies rarely cover the mess caused by a backup.

Equipment Breakdown Coverage

Some insurers offer this to cover mechanical failures. If you have an aerobic septic system with electrical pumps and aerators, this endorsement can pay to replace those expensive motors if they burn out suddenly.

Shopping Tips

When looking for quotes from major carriers like State Farm, Allstate, or Liberty Mutual, do not just ask for “Homeowners Insurance.” Explicitly ask:

- “Do you offer Service Line Coverage?”

- “Does that Service Line coverage include septic lines and the tank?”

- “What is the deductible for Water Backup coverage?”

Taking 10 minutes to ask these questions can save you $10,000 later.

Septic Tank Maintenance Tips to Avoid Claims & Save Money

The best insurance claim is the one you never have to file. Prevention is cheaper than repair, and it keeps you in good standing with your insurer.

According to the American Society of Sanitary Engineering (ASSE), proper maintenance can prevent up to 80% of septic failures. Here is your cheat sheet for keeping your system healthy:

The Three-Year Rule

Have your tank pumped and inspected by a professional at least every 3 to 5 years. If you have a large family or a garbage disposal, do it every 2 years. This removes the solids that can clog the drain field.

Mind What You Flush

Your toilet is not a trash can.

- Never Flush: Wipes (even “flushable” ones), feminine hygiene products, paper towels, cigarette butts, or cat litter.

- Kitchen Sink: Avoid pouring grease or oil down the drain. It hardens in the tank and blocks the inlet pipes.

Protect the Drain Field

Treat the grass above your drain field like a sanctuary.

- No Parking: Never drive vehicles over the field. It compacts the soil and breaks pipes.

- No Trees: Do not plant trees or large shrubs near the tank or field. Their roots are aggressive. Stick to grass or shallow-rooted flowers.

Watch Your Water Usage

Overloading the system with too much water at once can flush solids out of the tank before they settle. Spread out laundry loads over the week rather than doing five loads on Saturday morning.

install a Filter

Ask your pumper to install an effluent filter in the outlet tee of your tank. It costs about $100 and stops large solids from exiting the tank and ruining your expensive drain field. It’s cheap insurance for your system.

FAQs: Does House Insurance Cover Septic Tanks?

To wrap things up, let’s hit the most common questions we get, summarized for quick reading.

Does house insurance cover septic tanks?

Yes and No. It typically covers sudden, accidental damage (such as a vehicle impact or storm damage), but excludes wear and tear, rust, and neglect. You usually need extra endorsements for better protection.

What if my septic backs up into the house?

Standard policies usually exclude this. You need a specific “Water Backup and Sewer Overflow” endorsement to get coverage for the cleanup and repairs inside the home.

Are septic tanks covered in flood zones?

No. Standard homeowners’ insurance does not cover flood damage. You must buy a separate flood insurance policy (like through the NFIP), but even then, coverage for outdoor systems can be limited.

How much does septic coverage cost?

Adding Service Line Coverage (which protects the pipes and tank) usually costs between $50 and $80 per year. It is one of the most cost-effective riders you can buy.

What is the difference between septic tank and sewer line coverage?

Sewer line coverage protects the pipe connecting a home to the city sewer. Septic coverage applies to the self-contained tank and field on your property. However, many “Service Line” endorsements cover both types of pipes.